|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

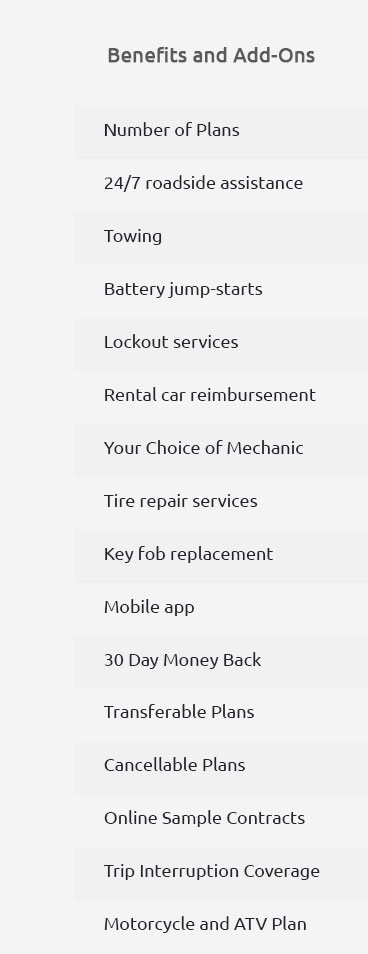

Extended Auto Coverage: Your Comprehensive GuideIn today's world, owning a vehicle is essential, but with it comes the responsibility of maintenance and repairs. Extended auto coverage is a valuable consideration for U.S. consumers seeking peace of mind and financial protection against unexpected repair costs. This guide delves into the benefits and details of extended auto coverage, helping you make informed decisions. Understanding Extended Auto CoverageExtended auto coverage, often referred to as an extended warranty, provides additional protection beyond the standard manufacturer's warranty. It covers repair costs for mechanical breakdowns, offering vehicle owners peace of mind and financial stability. Benefits of Extended Auto Coverage

Whether you're driving through the bustling streets of New York City or the open roads of Texas, having extended auto coverage ensures you're prepared for any eventuality. Cost ConsiderationsThe cost of extended auto coverage varies based on factors like vehicle make, model, age, and mileage. Generally, car warranty insurance cost can be influenced by your choice of provider and the level of coverage you opt for. Factors Affecting Cost

For older vehicles, you might explore options like an extended warranty for older vehicles to ensure continued protection. FAQsWhat does extended auto coverage typically include?Extended auto coverage often includes protection for major systems such as the engine, transmission, and electrical components. It may also cover additional benefits like roadside assistance and rental car reimbursement. Is extended auto coverage worth it for older vehicles?Yes, extended auto coverage can be particularly valuable for older vehicles, as they are more likely to experience mechanical issues. It can help manage repair costs and provide peace of mind. In conclusion, extended auto coverage is a worthwhile investment for vehicle owners in the U.S., offering financial protection and peace of mind. By considering your specific needs and researching different providers, you can find a plan that suits your situation, whether you're navigating the cityscape of Los Angeles or the rural roads of Montana. https://www.consumerreports.org/cars/car-repair/get-an-extended-warranty-for-your-car-a1570471227/

Extended warranties are a tempting option for consumers who buy a used car or for those who want to extend the bumper-to-bumper coverage on a new car. https://vehicleprotection.allstate.com/products/extended-vehicle-care

Allstate Extended Vehicle Care will pick up where your basic limited and powertrain warranties end, giving you up to 7 years and 100,000 miles of protection. https://consumer.ftc.gov/articles/auto-warranties-and-auto-service-contracts

Auto service contracts sometimes called extended warranties are optional contracts sold by vehicle manufacturers, dealers, or independent companies. The ...

|